An executive MBA can be a life-altering decision. I have met enough professionals who once pondered if an MBA would make any difference and if they should save for it first or take a loan instead.

My answer in all scenarios remains the same. It depends on case to case.

- A person with an 8-year developer career needs an MBA if they desire making it to managerial positions.

- A startup owner like me needs an MBA to present himself as a credible leader to employees and a capable executioner to customers.

- A person running a car showroom, an oil drilling engineer, a geoscientist, and similar professionals might not need an MBA to advance in their career.

For those who need an executive MBA, there are limited financing options available. Among these options, a loan is an easy way to finance.

Who Should Take a Loan For an Executive MBA?

Executive MBA was created for experienced professionals who can lead companies with their experience. For these people, an MBA is just a way to help them become better managers. Hence, anyone who has decent work experience and wants to switch to managerial positions can do an executive MBA.

Below is a small must-have checklist before you choose to do an executive MBA.

- The person should be clear about their goals.

- They should not need post-MBA placements or job assistance.

- Have at least 5 years of work experience.

- Have built enough contacts in their industry.

Having these basic qualifications also eliminates the online vs offline debate.

Loans Are Not A Good Choice For These People

Loans can land you in financial stress and also in legal trouble if you do not plan them accordingly or take them just because you do not want to pay the MBA fees from your pocket.

For those willing to do an MBA but have financial constraints, an online MBA is a much better choice.

Candidates With Low Work Experience

People with less than 5 years of experience or those who have not yet settled well into their careers should not do an executive MBA. The reason is simple: most executive MBAs in India, both online and offline, do not offer placement assistance, and the candidate is left on their own to secure a job.

This is the reason I went for a full 2-year online MBA.

Candidates Who Are Seeking to Change Careers

This is also true for those who wish to do an executive MBA to change their career path. For these people, it is important to remember that as soon as you change into an unrelated profession (from IT to marketing), you suddenly become a fresher in that field. Hence, you lose all the work experience that you have earned in your field.

We had a batchmate who was from the content writing field and chose an MBA in Finance to change to another field. At the end of the course, he was left without a job and had to take up another 1-year finance course to bridge the gap.

In any case, I feel the best way to change careers is to take a crash course, gain at least two years of work experience, and then pursue an MBA.

Candidates with Bad Financials

Never take an MBA just because you think the degree will pay for itself. I have seen many get in trouble and seeking parent’s help to pay their fees.

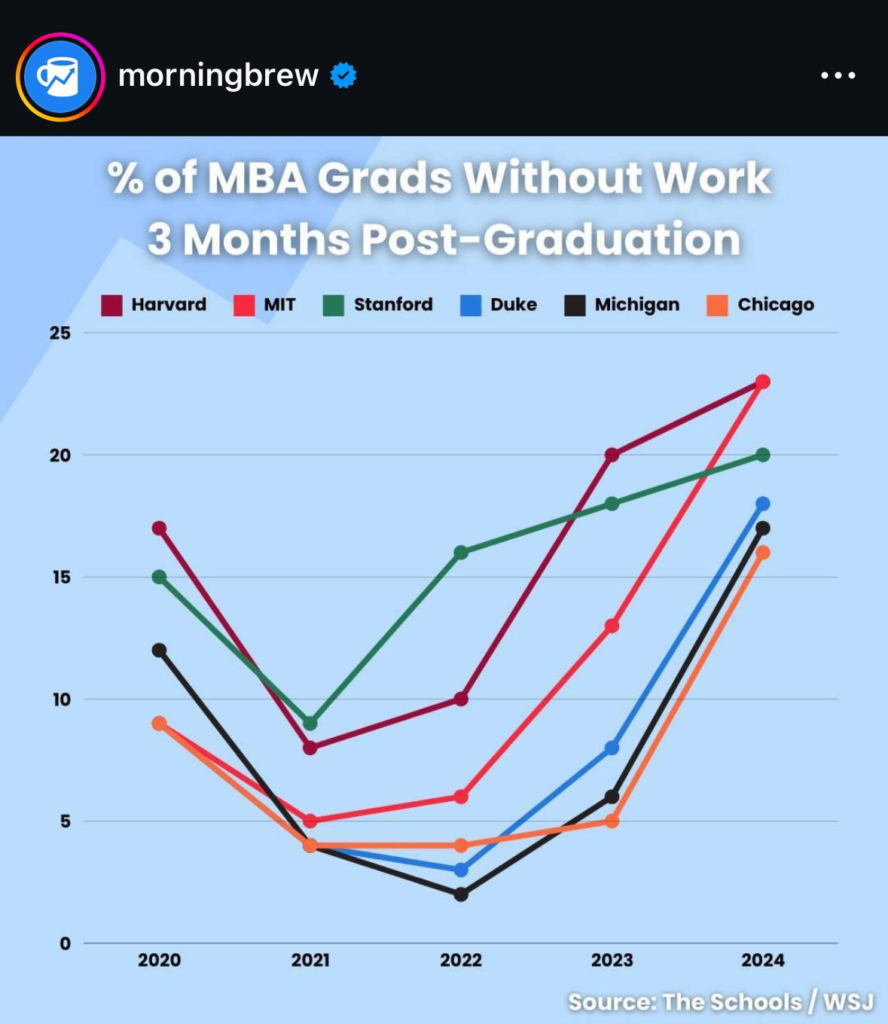

Markets sometimes go inflationary, making it harder for companies to hire more MBAs. Or there can be a recession where hiring is paused due to revenue constraints. In such scenarios, we have seen candidates stuck with a degree but without a job.

Its best only to take a loan only if you can afford to pay with your pre-MBA salary/income.

Do’s and Dont’s For Taking a Loan

My finance degree (MBA) and personal experience have taught me one thing very well. Loans can be a boon if you ration their payments properly, but if you mishandle them, they will suck the money out of your bank.

Before Taking a Loan

Before taking loans, they need to ensure that their livelihood can support their loan.

A thumb rule used by finance experts is that the total amount of EMIs and loans should not cross 20% of their monthly income.

Further, they also need to ensure that the loan interest rates are not higher than average market rates.

After Taking a Loan

After taking a loan, if possible, the candidate should start an additional SIP in mutual funds, recurring deposits, or index funds to offset the loan interest.

Also, the user should set their spending according to their new EMI commitments.